Contact Us Today! (812) 288-9000 | info@brookstonefinancial.com

Insights on Market Volatility | Seth Stewart at Brookstone Financial

In today’s ever-changing financial landscape, understanding market volatility is essential for any investor aiming to navigate the tumultuous waters of the stock market. Seth Stewart, a seasoned financial advisor at Brookstone Financial in Jeffersonville, IN, sheds light on the intricacies of market volatility and offers actionable strategies to help investors weather the storm.

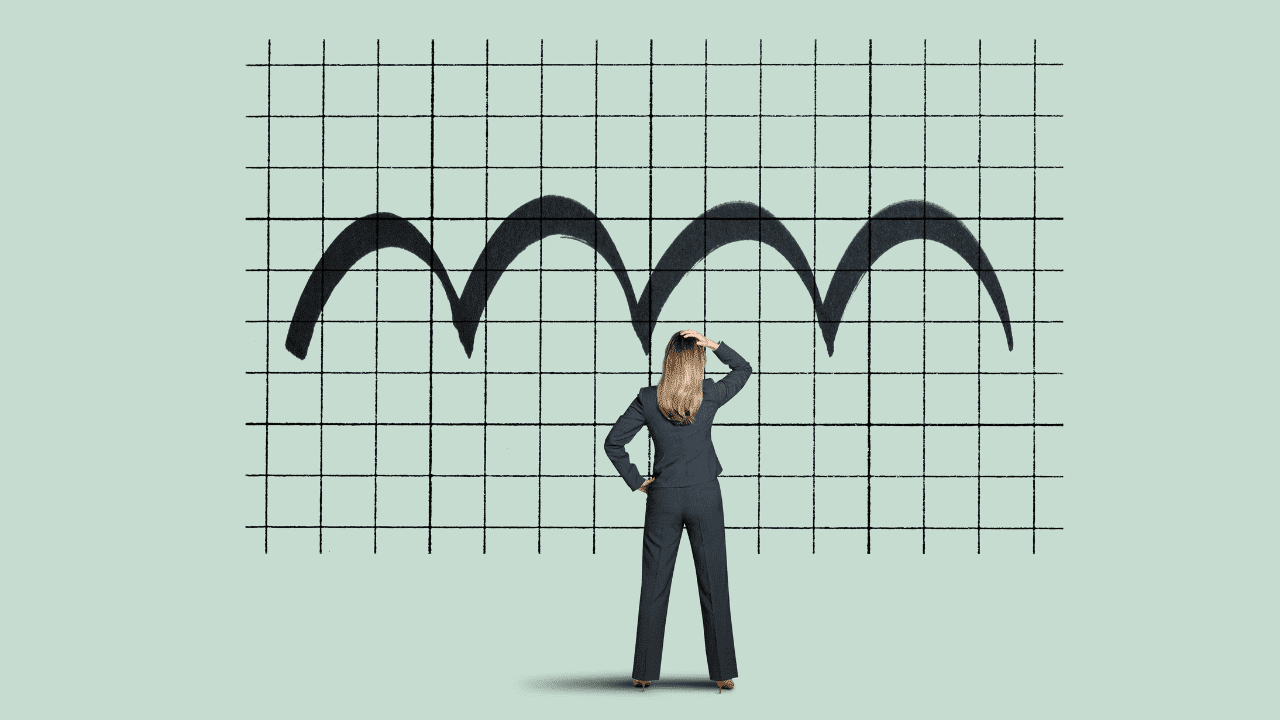

Market volatility refers to the rapid and unpredictable fluctuations in stock prices and market indices. While it can be unnerving for investors, Seth emphasizes that volatility is a natural part of the market cycle and presents opportunities for those who are prepared. He explains that market volatility can stem from various factors, including economic data releases, geopolitical events, and changes in investor sentiment.

One key aspect Seth highlights is the importance of maintaining a long-term perspective. Instead of reacting impulsively to short-term market fluctuations, investors should focus on their long-term financial goals. Seth advises his clients at Brookstone Financial to adopt a diversified investment approach tailored to their risk tolerance and investment objectives. By spreading investments across different asset classes, sectors, and geographic regions, investors can mitigate the impact of market volatility on their portfolios.

Additionally, Seth emphasizes the significance of staying informed and educated about market trends and developments. At Brookstone Financial, Seth and his team provide clients with timely market updates and investment insights to help them make informed decisions. By staying informed, investors can understand the underlying factors driving market volatility and make rational investment decisions based on sound analysis rather than emotions.

Furthermore, Seth stresses the importance of regularly reviewing and rebalancing investment portfolios. As market conditions change, the asset allocation within a portfolio may drift from its original targets. By periodically rebalancing, investors can realign their portfolios to maintain the desired risk-return profile and ensure they remain on track to achieve their financial objectives.

In times of heightened market volatility, Seth advises investors to avoid making impulsive decisions driven by fear or greed. Instead, he encourages them to stay disciplined and stick to their long-term investment plan. By focusing on factors within their control, such as asset allocation, diversification, and disciplined saving habits, investors can navigate market volatility with confidence.

Moreover, Seth underscores the importance of seeking professional guidance from a qualified financial advisor like those at Brookstone Financial. With their experience, financial advisors can provide personalized recommendations tailored to each client’s unique financial situation and goals. By working closely with a trusted advisor, investors can develop a comprehensive financial plan that accounts for market volatility and adapts to changing circumstances over time.

In conclusion, understanding market volatility is essential for investors seeking to navigate the complexities of the financial markets. By maintaining a long-term perspective, staying informed, diversifying their portfolios, and seeking professional guidance, investors can effectively navigate market volatility and stay on course to achieve their financial goals. With Seth Stewart and the team at Brookstone Financial in Jeffersonville, IN, investors have access to the guidance needed to navigate market volatility with confidence.